INFORMATION FOR TAX-FREE PROCEDURES

Person eligible for tax exemption

Non-Japanese: A person who is not residing in Japan and whose status of residence is “Short-Term Stay,” “Diplomat,” or “Official.”

Japanese: A person who has been continuously residing in a foreign country for two years or longer (entry stamp required).

Application period

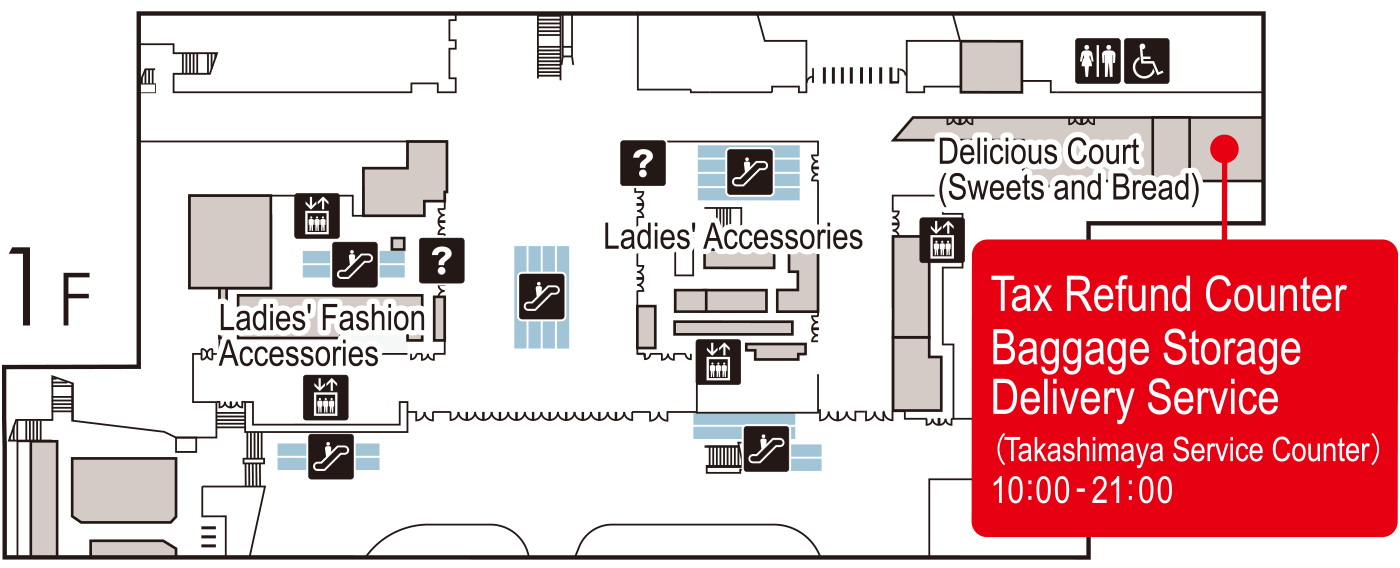

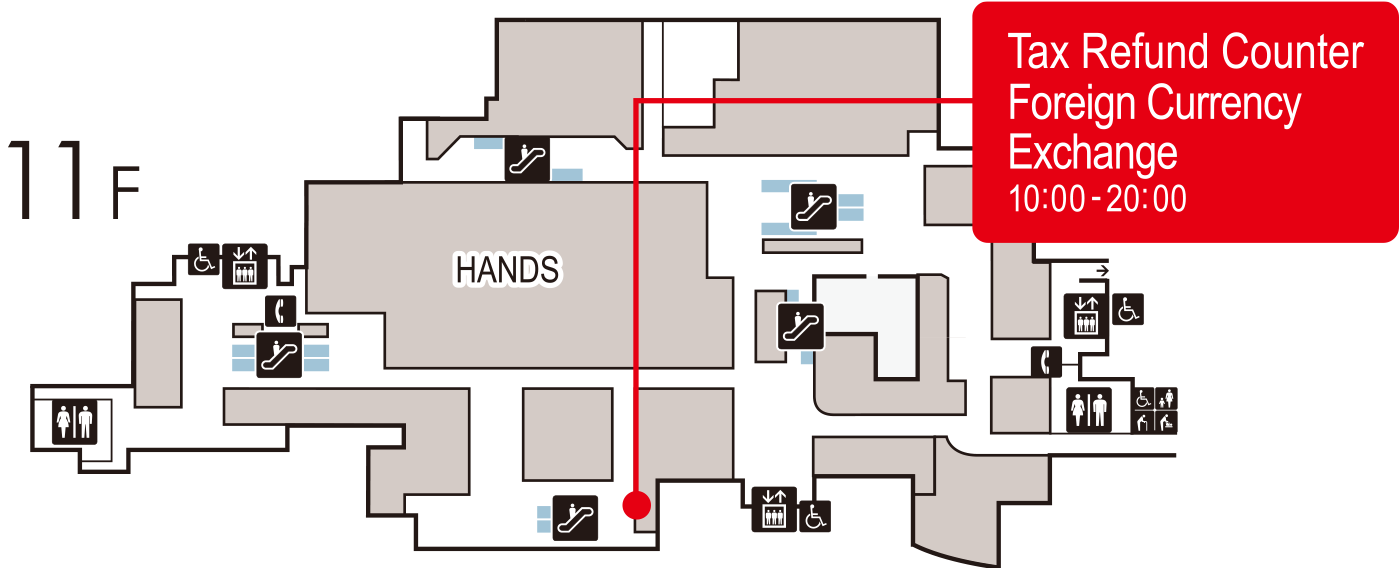

10:00 - 21:00 on date of purchase

- The 1F Tax Refund Counter closes at 21:00

- The 11F Tax Refund Counter closes at 20:00

Product categories

General merchandise

Products excluding consumables for use in Japan, including fashion apparel, sundries, select brand name items, watches, and kimonos

[Total purchase] At least ¥5,000 in a single day (excluding tax)

Consumables

Consumables not for use in Japan : Cosmetics, health food and grocery items, etc.

[Total purchase] Between ¥5,000 and ¥500,000 in a single day (excluding tax)

General merchandise + Consumables

Purchase totals the above

[Total purchase] Between ¥5,000 and ¥500,000 in a single day (excluding tax)

Products not eligible

Restaurant bills, shipping, repair costs, etc.

Scope

Products for personal consumption (not commercial use)

Items required for application

- 1.Receipts

- 2.Your passport (landing permission stamp required)

- 3.Your credit cards (if used)

- 4.Items purchased

- 5.Copy of residency certificate or family register (only Japanese people living overseas)

The name on the credit card must match that on your passport.

Refund

cash, credit card, Alipay, WeChat Pay

Fee

1.55% of the price of tax-exempt products is collected.

Place for tax exemption procedures

1F Tax Refund Counter (Takashimaya Service Counter)

11F Tax Refund Counter

- Takashimaya points will be applied only to the card of the person applying for the tax exemption.

- Please be aware that if you wish to take meats and other livestock products, seafood, vegetables, fruits and other agricultural products out of the country, you must undergo an export inspection at either the Animal Quarantine Service or Plant Protection Station. If the above products don't undergo an export inspection when departing Japan, they will be confiscated at immigration.

- Please be aware that there are some countries or regions which, by laws and ordinances, forbid you to bring in food items. Please be sure to check the customs regulations of your own country or whichever country you are going to visit after Japan. If you are prevented from bringing these items into another country or region, we cannot take responsibility for the situation.

- Embassy employees living in Japan must show a Tax Exemption Card in their name.

- Crew members, e.g., airplane crews, must show Landing Permission for Crew Members with their name on it.

- The total amount of purchases made at JR Nagoya Takashimaya and Takashimaya Gate Tower Mall (some stores excluded) is eligible for tax refunds. Cannot be combined with HANDS. Tax refunds for items purchased at HANDS are available at the 11F Information Counter at HANDS.

- For items purchased at JR Nagoya Takashimaya Watch Maison, you cannot carry out the tax exemption procedure at the Tax Refund Counter in the JR Nagoya Takashimaya department store main building.

- For items purchased in the JR Nagoya Takashimaya department store main building or at Takashimaya Gate Tower Mall, you cannot carry out the tax exemption procedure at the Tax Refund Counter at JR Nagoya Takashimaya Watch Maison.

- You cannot combine items purchased at JR Nagoya Takashimaya department store main building and/or at Takashimaya Gate Tower Mall together with items purchased at JR Nagoya Takashimaya Watch Maison.